In promoting his plan to “rescue America,” Sen. Rick Scott went too far in claiming that Medicare will go “bankrupt” in four years and Social Security in 12 years. Government trustees project that certain Medicare and Social Security trust funds would become depleted by then, but payments would continue, albeit at a reduced rate.

Scott made his remarks March 27 on “Fox News Sunday” when host John Roberts asked the Florida Republican about “An 11-Point Plan to Rescue America” — which is Scott’s blueprint for a Republican-controlled Congress after the 2022 elections.

Scott, chairman of the National Republican Senatorial Committee, discusses Medicare and Social Security in the plan under “Point Six: Government Reform/Debt.”

That section of his plan calls for sunsetting “all federal legislation” in five years, forcing Congress to act if it wants to keep federal programs. “If a law is worth keeping, Congress can pass it again,” the plan says. It also calls on “Congress to issue a report every year telling the public what they plan to do when Social Security and Medicare go bankrupt.”

Roberts asked why Scott’s plan would include a tax on all Americans and potentially sunset Medicare and Social Security. Scott dismissed the premise of Roberts’ question as “Democrat talking points,” even though Senate Republican Leader Mitch McConnell has said the same thing, as Roberts pointed out. (We wrote about Scott’s tax proposal here.)

“No one that I know of wants to sunset Medicare or Social Security, but what we’re doing is we don’t even talk about it,” Scott told Roberts. “Medicare goes bankrupt in four years. Social Security goes bankrupt in 12 years. I think we ought to figure out how we preserve those programs.”

For sure, the long-term financing of Social Security and Medicare has been and remains a problem, but – as we’ve written over the years — such “bankruptcy” claims could leave the wrong impression. Neither program is going out of business.

The two Social Security trust funds — the Old-Age and Survivors Insurance Trust Fund and the Disability Insurance Trust Fund — combined would be depleted by 2034, according to the most recent report released in August by the Social Security Board of Trustees. That’s the basis of Scott’s claim that Social Security will go “bankrupt” in 12 years.

Even if the trust funds are depleted, though, the program would still collect enough in annual tax revenues and interest payments to pay about three-quarters of the benefits now promised.

“After the projected trust fund reserve depletion in 2034, continuing income would be sufficient to pay 78 percent of program cost, declining to 74 percent for 2095,” a summary of the report says.

As the summary further explains, the trust funds receive income from a 12.4% payroll tax on earnings (up to a maximum of $142,800 in 2021). Employees and their employers each pay a 6.2% payroll tax, while self-employed workers pay the full 12.4%. In addition, more than 40% of Social Security beneficiaries pay income taxes on part of their benefits, and part of those tax revenues go to the program’s trust funds, as does interest on trust fund reserves.

As for Medicare, the Hospital Insurance Trust Fund — which helps pay for inpatient hospital care under Medicare Part A — is expected to be depleted in four years, by 2026, according to the Medicare Board of Trustees. But the “continuing total program income will be sufficient to pay 91 percent of total scheduled benefits,” according to a summary of the report.

“Under current law, scheduled HI tax and premium income would be sufficient to pay 91 percent of estimated HI cost after trust fund depletion in 2026, declining to 78 percent by 2045, and then gradually increasing to 91 percent by 2095,” the summary says.

The HI trust fund is financed largely (see table 4) through a payroll tax, which is currently 1.45% for the employer and 1.45% for the employee for a total of 2.9% on earnings up to $200,000. There is an additional Medicare payroll tax of 0.9% that individual employees must pay on earnings above $200,000. The HI trust fund also receives funding from income tax revenue on Social Security benefits, interest on trust fund reserves, beneficiary premiums and other sources.

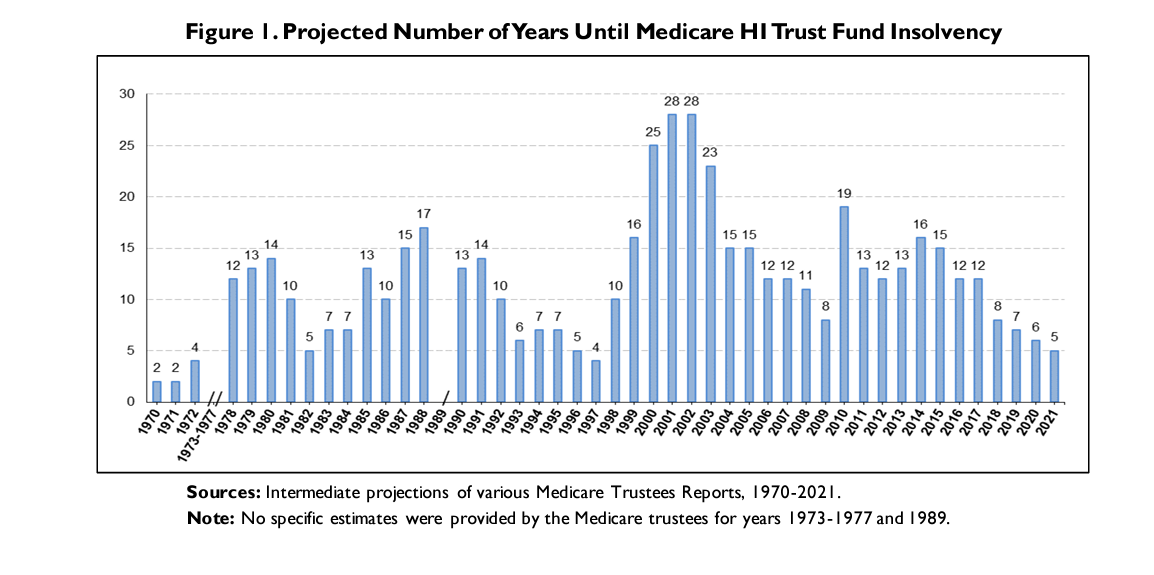

Also, the trustees have been warning about the depletion of the Part A trust fund since 1970, but, as the Congressional Research Service explains: “The HI trust fund has never become insolvent.” (See CRS chart below.) Congress has always taken some action, such as raising payroll taxes or restraining spending growth, to extend the life of the fund.

There is another trust fund — the Supplemental Medical Insurance Trust Fund — for “Part B, which helps pay for services such as physician and outpatient hospital care, and Part D, which covers prescription drug benefits,” according to a summary of the trustees’ report. But that fund “is adequately financed into the indefinite future because current law provides financing from general revenues and beneficiary premiums each year to meet the next year’s expected costs,” the summary says.

There is another trust fund — the Supplemental Medical Insurance Trust Fund — for “Part B, which helps pay for services such as physician and outpatient hospital care, and Part D, which covers prescription drug benefits,” according to a summary of the trustees’ report. But that fund “is adequately financed into the indefinite future because current law provides financing from general revenues and beneficiary premiums each year to meet the next year’s expected costs,” the summary says.

In a Fox Business opinion piece published in May 2020, Scott said Congress must deal with “our looming fiscal crisis” caused by “excess government spending and borrowing.” In that same piece, he said that Social Security and Medicare “must be preserved, reformed and protected.” We asked his office how he would reform the programs, but it did not respond. The senator’s 11-point plan also does not provide any proposal for changing the programs to make them more sustainable.

Editor’s note: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Please consider a donation. Credit card donations may be made through our “Donate” page. If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.