In a series of stories over the coming days, we will lay out numerous examples of how President Donald Trump has implemented Project 2025 proposals and how at times he diverged from the document. We start today with the document’s promise to “dismantle the administrative state.”

Locations: National

Few Mass Shooters Have Been Transgender

Q: Have many of the mass shooters been transgender?

A: The number of transgender mass shooters in the U.S. varies depending on how “mass shooting” is defined, but is relatively small. The Gun Violence Archive, which uses a broader definition, lists five mass shootings by transgender or nonbinary people since January 2013. That’s less than 0.1% of the mass shootings it says happened in that period.

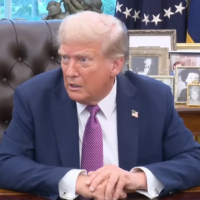

Trump Again Overstates Number of Drug Overdose Deaths in U.S.

Reviving an unfounded claim he has made for several years, President Donald Trump on Sept. 5 overstated the number of Americans who died in 2024 of drug overdoses, saying that he believed 300,000 or “350,000 people died last year from drugs.” A spokesperson for the Centers for Disease Control and Prevention told us the provisional number of drug overdose deaths in 2024 was 79,383, and an expert in addiction medicine told us Trump’s number was “a gross exaggeration.”

COVID Vaccines Are Harder to Get, Despite Claims from HHS, RFK Jr.

Heated exchanges between some senators and Health and Human Services Secretary Robert F. Kennedy Jr. during a Sept. 4 hearing amplified confusion about the availability of COVID-19 vaccinations for the fall, with Kennedy misleadingly claiming that “anybody” can still get a vaccine. HHS policies have created roadblocks to vaccine access.

Trump on EU and Japan Investments in the U.S.

Assessing Redistricting Claims from Texas, New York Governors

Are Prices Up or Down? Parsing Misleading Claims by Trump and Democrats

About six months into the second term of President Donald Trump, Republicans and Democrats are making conflicting and often misleading assessments of the Trump administration’s impact on inflation and prices. Both sides cherry-pick examples of consumer products to support their claims, while sometimes wrongly taking credit for lower prices or falsely casting blame for rising costs.

Trump’s Hollow Surplus Claim

In recent speeches and media scrums, President Donald Trump has lauded the federal budget surplus for the month of June, claiming the surplus had not happened in “many, many years” or “decades.” To be clear, the U.S. had not recorded a surplus in June since 2016 – but the country has had several surpluses in other months since that time.

Border Czar Makes Misleading Claim About Immigrants With Criminal Records

Border Czar Tom Homan has been repeating the misleading claim that there are “over 600,000 illegal aliens with criminal records walking the streets of this nation.” That number includes legal immigrants, not just those who entered the country illegally; about a third of them have only been charged, not convicted; and it’s unclear how many of them have been, or currently are, incarcerated.

The CBO Breakdown on Medicaid Losses, Increase in Uninsured

The Congressional Budget Office estimated that the House version of the One Big Beautiful Bill Act would reduce Medicaid enrollment and cause millions of people to become uninsured by 2034. It didn’t say that “5 million” of the people who are “going to lose insurance” would have “other insurance” so “they’re still insured,” as National Economic Council Director Kevin Hassett misleadingly claimed.